Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "tax laws"

Status: Preview

Status: PreviewLund University

Skills you'll gain: Corporate Sustainability, Environment and Resource Management, Materials Management, Natural Resource Management, Supply Chain Management, Waste Minimization, Environmental Issue, Business Modeling, Environmental Social And Corporate Governance (ESG), Environmental Policy, Product Design, Innovation, Resource Utilization, Business Transformation, Process Analysis, Policy Analysis, Business Analysis, Stakeholder Engagement

Status: Free Trial

Status: Free TrialSkills you'll gain: Analytics, Data Governance, Supply Chain Management, Data Storytelling, Data Presentation, Data Analysis, Supply Chain Planning, Business Analytics, Presentations, Demand Planning, Supply Chain Systems, Data-Driven Decision-Making, Descriptive Analytics, Forecasting, Data Quality, Inventory Management System, Inventory and Warehousing, Business Technologies, Data Visualization, Problem Solving

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Tax Management, Partnership Accounting, Income Tax, Corporate Tax, Tax Planning, Tax Laws, Tax, Organizational Structure, Liquidation, Property Accounting, Ethical Standards And Conduct, Business Analysis

Alfaisal University | KLD

Skills you'll gain: Bank Regulations, Financial Regulation, International Finance, Banking, Compliance Reporting, Process Analysis, Continuous Monitoring, Commercial Laws

Status: Preview

Status: PreviewKorea Advanced Institute of Science and Technology(KAIST)

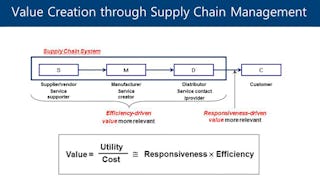

Skills you'll gain: Supply Chain Management, Supply Chain, Quality Management, Supplier Relationship Management, New Product Development, Inventory Management System, Corporate Sustainability, Operational Efficiency, Continuous Improvement Process, Consumer Behaviour, Cross-Functional Collaboration, Decision Making

Status: Free Trial

Status: Free TrialUniversity of Illinois Urbana-Champaign

Skills you'll gain: Depreciation, Property Accounting, Tax Laws, Income Tax, Corporate Tax, Fixed Asset, Tax Compliance, Specialized Accounting, Capital Expenditure

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Working Capital, Financial Statement Analysis, Financial Statements, Financial Accounting, Income Statement, Accounting, Balance Sheet, Accounts Receivable, Accounts Payable and Receivable, Equities, Fixed Asset, Inventory Accounting, Securities (Finance), Loans, Cash Flows, Depreciation, Capital Expenditure, Mortgage Loans, Income Tax

Status: Preview

Status: PreviewUniversity of Illinois Urbana-Champaign

Skills you'll gain: Corporate Tax, Sales Tax, Tax Laws, Income Tax, Tax Compliance, Tax Planning, Property and Real Estate, Case Law, Consolidation

Status: Preview

Status: PreviewUniversity of Lausanne

Skills you'll gain: Mergers & Acquisitions, Equities, Accounting, Accounts Receivable, Tax, Inventory Accounting, Corporate Tax, Financial Accounting, Depreciation, Consolidation, Balance Sheet, Asset Management, Corporate Finance, Financial Statement Analysis, Financial Reporting, Revenue Recognition, Financial Statements

Status: Free Trial

Status: Free TrialUniversity of Pennsylvania

Skills you'll gain: Financial Statements, Financial Modeling, Financial Statement Analysis, Capital Budgeting, Financial Forecasting, Decision Making, Return On Investment, Financial Analysis, Business Modeling, Business Valuation, Cash Flow Forecasting, Data-Driven Decision-Making, Balance Sheet, Cash Flows, Risk Analysis, Spreadsheet Software, Tax Management

Status: Free Trial

Status: Free TrialSkills you'll gain: IT Service Management, Governance Risk Management and Compliance, Information Technology Infrastructure Library, Regulatory Compliance, Data Ethics, Compliance Management, Cyber Risk, Cyber Security Policies, NIST 800-53, Cybersecurity, Regulatory Requirements, Cyber Security Strategy, IT Automation, ISO/IEC 27001, General Data Protection Regulation (GDPR), Compliance Auditing, Artificial Intelligence, Payment Card Industry (PCI) Data Security Standards, Risk Management, Open Web Application Security Project (OWASP)

Status: Free Trial

Status: Free TrialSkills you'll gain: Sales Tax, Payroll Tax, Payroll, Reconciliation, Ledgers (Accounting), Accounting, Accounts Payable, Balance Sheet, Accrual Accounting, Financial Statements, Commercial Lending, Profit and Loss (P&L) Management, Bookkeeping, Equities, Loans

In summary, here are 10 of our most popular tax laws courses

- Circular Economy - Sustainable Materials Management: Lund University

- Unilever Supply Chain Data Analyst: Unilever

- Taxation of Business Entities II: Pass-Through Entities: University of Illinois Urbana-Champaign

- مكافحة غسل الأموال | Anti Money Laundering: Alfaisal University | KLD

- Supply Chain Management: A Learning Perspective : Korea Advanced Institute of Science and Technology(KAIST)

- Federal Taxation II: Property Transactions of Business Owners and Shareholders: University of Illinois Urbana-Champaign

- More Introduction to Financial Accounting: University of Pennsylvania

- Multistate Taxation: University of Illinois Urbana-Champaign

- Accounting 2: University of Lausanne

- Decision-Making and Scenarios: University of Pennsylvania